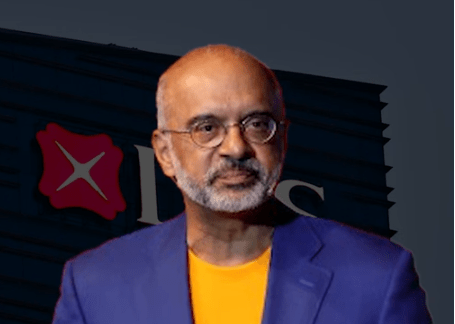

With a salary of S$11.2 million (about $8.34 million) in 2023, Piyush Gupta was the CEO of DBS. After receiving S$15.4 million in 2022, his total pay dropped by 27.3%. The 30% fall in variable pay was the result of many disruptions to DBS’s digital banking services, which led to the reduction.

DBS CEO Salary and Career Overview

| Name | Piyush Gupta |

|---|---|

| Position | CEO of DBS Group |

| Total Salary (2023) | S$11.2 million (US$8.34 million) |

| Total Salary (2022) | S$15.4 million |

| Variable Pay Cut | 30% reduction (S$4.14 million) |

| Company | DBS Group |

| Industry | Banking and Finance |

| Years as CEO | Since 2009 |

| Headquarters | Singapore |

Source: DBS Annual Report 2023

The DBS CEO’s Salary CUT: Why?

In 2023, DBS had a slew of problems with their digital banking services. Regulatory action was taken by the Monetary Authority of Singapore (MAS) due to the impact these instances had on customers. In an effort to hold Gupta to account, DBS reduced his variable salary by 30%.

Record earnings were generated by DBS in 2023, despite the challenges. Return on equity (ROE) for the bank was 18%, ranking it among the top worldwide. The board, however, downgraded Gupta’s performance review, pointing to technological shortcomings as the main reason.

Analysis of the Salary Reduction

In February 2024, DBS made public the $4.14 million salary cut. Cuts to their variable salary were imposed on the whole senior management team. The bank’s technological failures, according to Gupta, are the fault of the leadership team.

Improved system resilience was his main point. The importance of responsibility in banking leadership was also pointed up by him.

Regulatory Actions Against DBS

MAS imposed several restrictions on DBS following the banking disruptions:

- Acquisition Ban – DBS was barred from acquiring new businesses for six months.

- IT Restrictions – The bank was required to pause non-essential IT upgrades.

- Network Restrictions – DBS could not reduce its branches or ATMs in Singapore.

The restrictions were aimed at improving technology infrastructure. MAS wanted DBS to strengthen its systems before pursuing new ventures.

How Does the DBS CEO Salary Compare?

Piyush Gupta remains one of the highest-paid CEOs in Singapore. However, the 2023 pay cut lowered his earnings relative to other bank CEOs.

| Bank | CEO | Total Compensation (2023) |

|---|---|---|

| DBS Group | Piyush Gupta | S$11.2 million |

| OCBC Bank | Helen Wong | S$10.3 million |

| UOB Bank | Wee Ee Cheong | S$9.8 million |

Even with the salary cut, Gupta still earned more than most banking CEOs in Singapore.

DBS’s Record-Breaking Financial Year

Despite the pay cut, DBS delivered a record-breaking year in 2023. Key highlights included:

- Net profit: Over S$10 billion

- Return on Equity (ROE): 18%

- Growth in digital banking and asset management

DBS continued to lead Southeast Asia’s banking sector. The bank’s strong financial position ensured investor confidence.

Will the DBS CEO Salary Increase in 2024?

Gupta’s salary may increase in 2024 if DBS successfully resolves its digital banking issues. The bank is investing heavily in technology upgrades. Strengthening system security and performance remains a key focus.

If DBS demonstrates improved stability, the board may restore Gupta’s full compensation.

Public Reaction and Market Impact

The salary cut sparked mixed reactions. Some praised DBS’s accountability, while others argued that record profits should reflect in executive compensation.

- Investors remained confident in DBS despite the restrictions.

- Market analysts expect DBS to rebound from its technology setbacks.

- Public opinion was divided on whether the salary cut was justified.

DBS shares continued to trade at strong levels, showing long-term confidence in the bank’s leadership.

Piyush Gupta’s Leadership at DBS

Since taking over in 2009, Gupta has transformed DBS into a global banking leader. His key achievements include:

- Expanding DBS into China, India, and Southeast Asia.

- Leading digital banking innovation.

- Driving consistent revenue and profit growth.

Gupta is recognized as one of Asia’s top banking executives. His leadership remains critical to DBS’s future success.

Future Outlook for DBS and Gupta

DBS remains financially strong despite technology issues. The bank is expected to continue its growth strategy in Asia. Gupta’s leadership will play a key role in ensuring operational improvements.

While his salary was reduced in 2023, the bank’s long-term strategy remains intact. If DBS successfully addresses its challenges, Gupta may see his full compensation restored in future years.

Short FAQs on DBS CEO Salary

- How much does the DBS CEO earn?

Piyush Gupta earned S$11.2 million (US$8.34 million) in 2023. - Why was Piyush Gupta’s salary cut?

His variable pay was reduced by 30% due to DBS’s digital banking disruptions. - How does his salary compare to other bank CEOs?

Despite the cut, he remains one of Singapore’s highest-paid banking CEOs. - Did DBS make a profit in 2023?

Yes, DBS posted record profits with an 18% return on equity. - Will his salary increase in 2024?

If DBS resolves its technology issues, his pay could rise again. - What restrictions did MAS place on DBS?

MAS froze acquisitions, paused IT upgrades, and restricted network reductions.